Unlocking the Landscape: A Comprehensive Guide to Anderson County Tax Maps

Related Articles: Unlocking the Landscape: A Comprehensive Guide to Anderson County Tax Maps

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unlocking the Landscape: A Comprehensive Guide to Anderson County Tax Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking the Landscape: A Comprehensive Guide to Anderson County Tax Maps

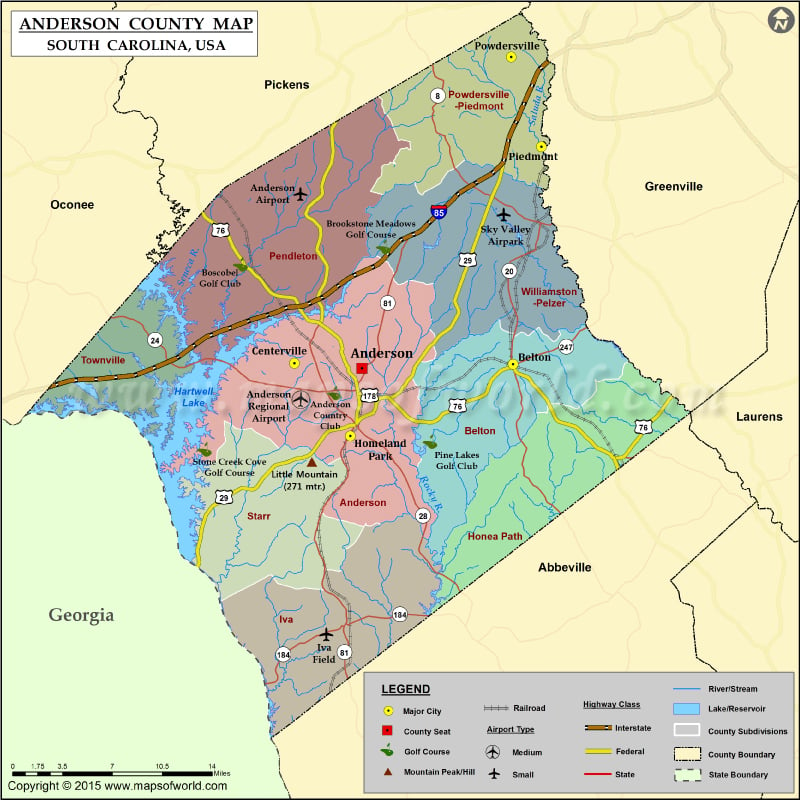

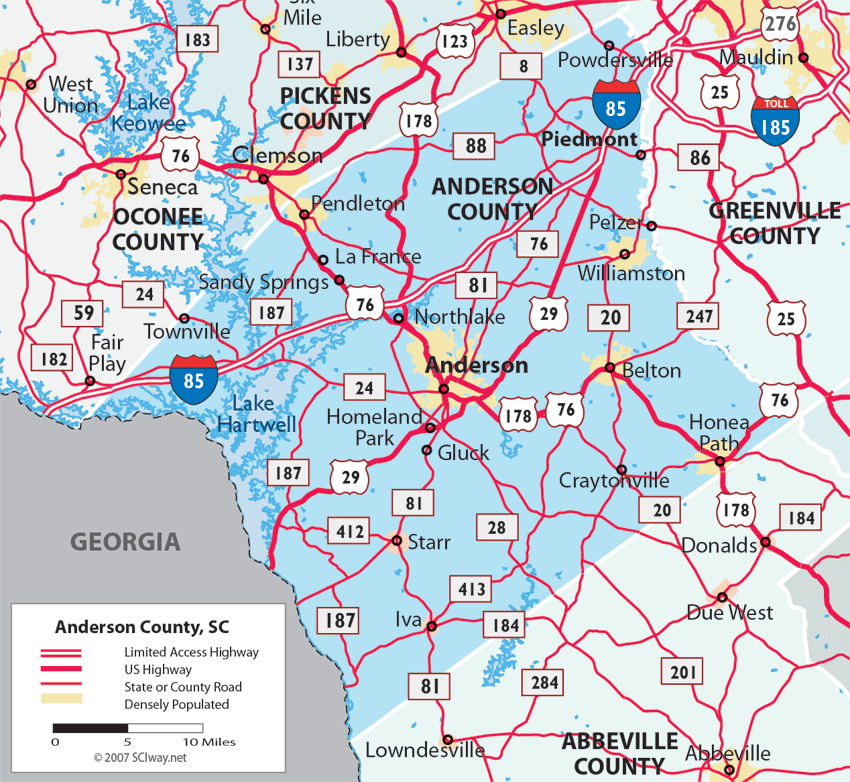

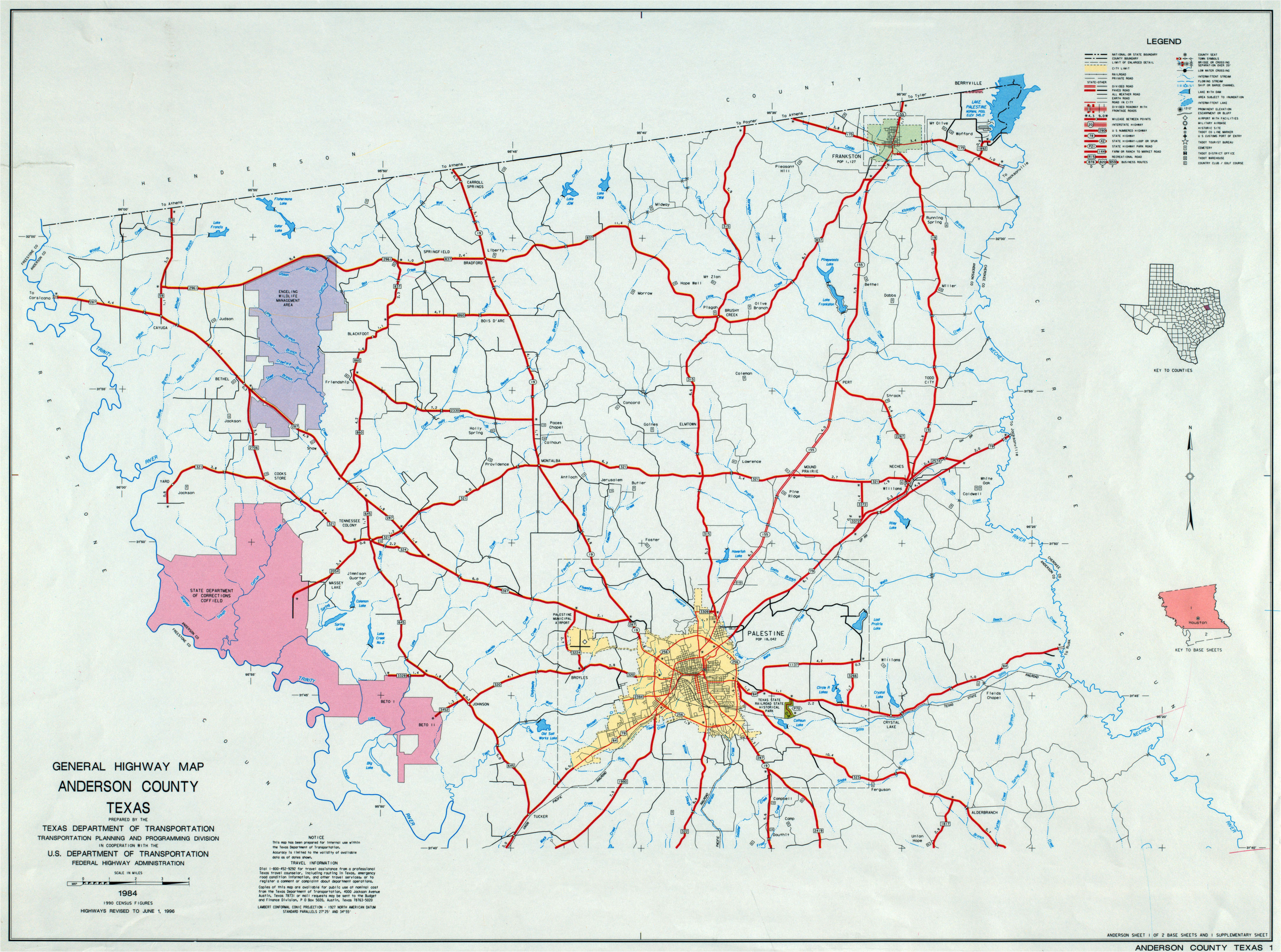

Anderson County tax maps, often referred to as property tax maps, serve as essential tools for navigating the intricate world of land ownership and property valuation. They provide a visual representation of the county’s land, meticulously detailing property boundaries, ownership information, and tax assessment data. This comprehensive guide explores the intricacies of Anderson County tax maps, outlining their significance, accessibility, and practical applications.

The Foundation of Property Management:

Anderson County tax maps are the cornerstone of property management, offering a clear and concise visual representation of the county’s real estate landscape. They are meticulously crafted, incorporating data from various sources, including:

- Parcel Boundaries: Precisely outlining the limits of each individual property, ensuring clarity and avoiding disputes.

- Ownership Information: Identifying the current legal owner of each property, facilitating communication and property transactions.

- Property Assessments: Reflecting the estimated market value of each property, forming the basis for property tax calculations.

- Property Classifications: Categorizing properties into various types, such as residential, commercial, or agricultural, enabling targeted tax policies.

Accessibility and Utilization:

Anderson County tax maps are readily accessible to the public, providing transparency and empowering informed decision-making. They can be accessed through various channels, including:

- Online Platforms: County websites often offer interactive tax map portals, allowing users to explore the maps, search for specific properties, and access detailed information.

- County Assessor’s Office: Physical copies of tax maps are available for public inspection at the county assessor’s office, offering a tangible reference point.

- Third-Party Providers: Specialized real estate data providers often incorporate Anderson County tax map data into their services, offering comprehensive property insights.

Benefits and Applications:

Anderson County tax maps serve a multitude of purposes, extending beyond property tax calculations. They are invaluable resources for:

- Real Estate Professionals: Real estate agents, brokers, and appraisers rely on tax maps to identify properties, assess their value, and understand market trends.

- Property Owners: Owners can use tax maps to verify their property boundaries, identify neighboring properties, and gain insight into their tax assessments.

- Developers and Investors: Tax maps provide crucial information for identifying suitable development sites, evaluating property values, and understanding zoning regulations.

- Government Agencies: Tax maps are instrumental for planning and development, enabling efficient allocation of resources, infrastructure projects, and emergency response planning.

FAQs about Anderson County Tax Maps:

1. How can I access the Anderson County tax map?

Anderson County tax maps are typically accessible online through the county’s website, the county assessor’s office, or through third-party real estate data providers.

2. What information is included on the Anderson County tax map?

Anderson County tax maps typically include parcel boundaries, property ownership information, tax assessments, property classifications, and other relevant data.

3. How often are Anderson County tax maps updated?

Tax maps are typically updated annually, reflecting changes in property ownership, assessments, and other relevant information.

4. Can I use Anderson County tax maps to determine property values?

While tax maps provide property assessments, it’s important to note that these assessments are not necessarily indicative of market value. A professional appraisal is recommended for determining accurate property values.

5. What are the legal implications of Anderson County tax maps?

Anderson County tax maps serve as official records, providing legal evidence of property boundaries and ownership. They are often used in legal proceedings involving property disputes.

Tips for Utilizing Anderson County Tax Maps Effectively:

- Familiarize yourself with the map’s legend: Understand the symbols and abbreviations used to represent different information.

- Utilize search functions: Online platforms often offer search tools to find specific properties by address, owner name, or parcel number.

- Verify information with official sources: Always confirm information obtained from tax maps with the county assessor’s office or other reliable sources.

- Consult with professionals: For complex property transactions or legal matters, seek guidance from real estate professionals or legal counsel.

Conclusion:

Anderson County tax maps are indispensable tools for navigating the intricate world of property ownership and management. They provide a clear and concise visual representation of the county’s real estate landscape, offering valuable insights for property owners, real estate professionals, developers, and government agencies alike. By leveraging the accessibility and information contained within these maps, individuals and organizations can make informed decisions, enhance property management practices, and foster a more transparent and efficient real estate market.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Landscape: A Comprehensive Guide to Anderson County Tax Maps. We thank you for taking the time to read this article. See you in our next article!