Navigating the Complexities of Taxes: A Comprehensive Guide to Kiplinger’s Tax Map

Related Articles: Navigating the Complexities of Taxes: A Comprehensive Guide to Kiplinger’s Tax Map

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Complexities of Taxes: A Comprehensive Guide to Kiplinger’s Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Complexities of Taxes: A Comprehensive Guide to Kiplinger’s Tax Map

The world of taxes can be a labyrinthine and often confusing landscape. From federal and state income taxes to property taxes and sales taxes, the sheer volume of regulations and complexities can be overwhelming for even the most financially savvy individuals. This is where resources like Kiplinger’s Tax Map become invaluable, offering a clear and comprehensive roadmap to navigate the intricacies of the tax system.

Understanding Kiplinger’s Tax Map

Kiplinger’s Tax Map is a comprehensive guide to the US tax system designed to simplify the process of understanding and managing one’s tax obligations. It encompasses a wide range of tax-related topics, including:

- Federal Income Tax: This section delves into the intricacies of federal income tax, covering topics such as filing statuses, deductions, credits, and tax brackets.

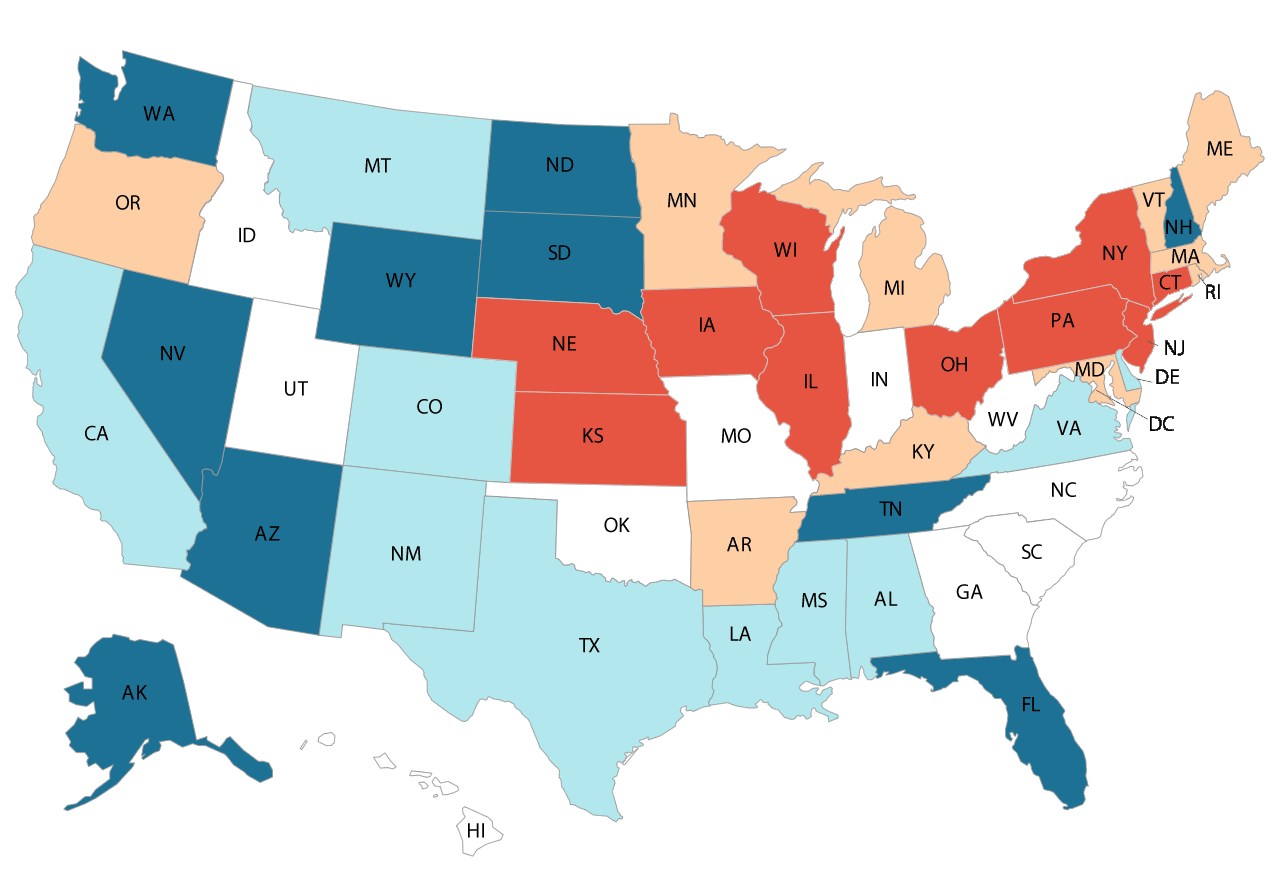

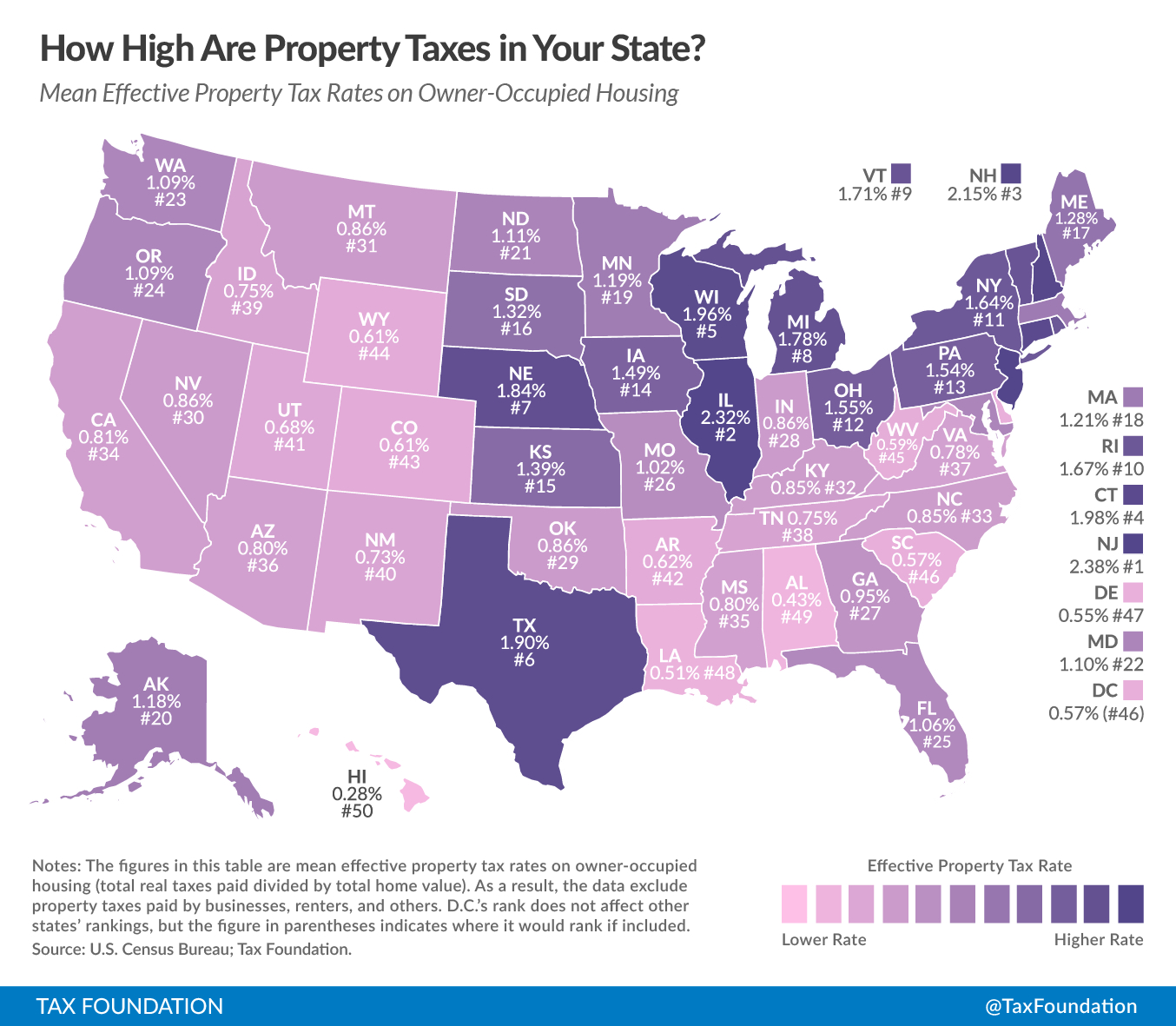

- State and Local Taxes: The map provides a detailed overview of state and local income taxes, property taxes, sales taxes, and other regional levies.

- Retirement Planning: Understanding the tax implications of retirement savings is crucial. Kiplinger’s Tax Map clarifies the tax treatment of IRAs, 401(k)s, and other retirement accounts.

- Estate Planning: The map explores the tax implications of estate planning, including inheritance taxes, gift taxes, and trusts.

- Business Taxes: For entrepreneurs and small business owners, the map offers insights into the various taxes applicable to businesses, including corporate income tax, payroll taxes, and sales taxes.

Benefits of Utilizing Kiplinger’s Tax Map

The benefits of using Kiplinger’s Tax Map extend beyond simply understanding the tax system. It empowers individuals and businesses to:

- Maximize Tax Savings: The map highlights potential deductions, credits, and other strategies to minimize tax liability.

- Avoid Tax Penalties: By staying informed about tax deadlines and regulations, individuals can avoid penalties for non-compliance.

- Plan for Future Tax Liabilities: The map provides insights into future tax changes and helps individuals prepare for potential tax implications.

- Make Informed Financial Decisions: Understanding the tax implications of various financial decisions, such as buying a home or investing, allows for more informed choices.

- Simplify Tax Preparation: The map provides a clear and concise framework for organizing tax information and preparing tax returns.

Frequently Asked Questions (FAQs)

Q: What is the best way to utilize Kiplinger’s Tax Map?

A: Start by exploring the sections most relevant to your individual circumstances, such as federal income tax, retirement planning, or estate planning. Read through the information carefully and note any potential deductions, credits, or tax strategies that apply to your situation.

Q: Is Kiplinger’s Tax Map a substitute for professional tax advice?

A: While Kiplinger’s Tax Map provides valuable information, it is not a substitute for professional tax advice. Consult with a qualified tax advisor for personalized guidance and assistance with complex tax situations.

Q: How often is Kiplinger’s Tax Map updated?

A: Kiplinger’s Tax Map is regularly updated to reflect changes in tax laws and regulations. It is essential to consult the most current version of the map for accurate information.

Tips for Maximizing the Value of Kiplinger’s Tax Map

- Read the Map Thoroughly: Take the time to carefully review the information provided in each section of the map.

- Identify Relevant Tax Strategies: Focus on the sections that are most pertinent to your individual tax situation.

- Consult with a Tax Professional: Don’t hesitate to seek professional advice for complex tax matters.

- Stay Updated on Tax Changes: Keep informed about changes in tax laws and regulations through Kiplinger’s updates and other reliable sources.

Conclusion

Kiplinger’s Tax Map serves as a valuable resource for navigating the intricate landscape of the US tax system. By providing a clear and comprehensive overview of tax regulations, deductions, credits, and strategies, it empowers individuals and businesses to make informed financial decisions, maximize tax savings, and avoid potential penalties. While the map offers invaluable insights, it is important to remember that it should not be considered a substitute for professional tax advice. By utilizing Kiplinger’s Tax Map in conjunction with expert guidance, individuals can effectively manage their tax obligations and ensure financial security.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Complexities of Taxes: A Comprehensive Guide to Kiplinger’s Tax Map. We thank you for taking the time to read this article. See you in our next article!